Chip Technology for your Visa Cards

Chip card benefits

Your NBD credit and debit cards have chip technology that make them more secure and easier to use worldwide. Benefits include:

- Greater protection from fraud

The microchip embedded in your card encrypts your data, providing enhanced security against counterfeiting when used at a chip-enabled terminal - Easy to use at home or internationally

Less hassle using your chip card overseas! The chip technology is the global standard and is currently used in over 80 countries.

- Acceptable at non-chip-enabled card terminals

Your new card has the embedded chip as well as a magnetic stripe. If a store or merchant has not upgraded to chip technology, you will use your card as you did previously by swiping the magnetic stripe

Using a chip-enabled ATM

- Insert your card (chip side first). Do not remove it until prompted by the ATM. The ATM will clamp down on your card to hold it in place until the transaction is complete.

2. Enter your PIN, and follow the on-screen instructions.

3. Remove your card at the end of your transaction when prompted.

DIP, TAP AND SWIPE

Dip Method

At a chip-enabled terminal

- Instead of swiping, insert your card face up into the terminal

- Do not take the card out until the transaction is complete

Swipe Method

At a traditional terminal without chip technology

- Just swipe your card as you have done in the past

- Sign or enter your PIN, if asked

- Sign or enter your PIN, if asked, and remove the card

Tap Method (Contactless)

With the contactless feature, simply hold or tap your card against the terminal to complete your transaction. You will be able to make contactless payments on Point-of-Sale machines that support this feature. There is a limit of EC$200 per transaction for all contactless payments. Please note that ONLY this method is subject to this amount to help safeguard against fraud.

Frequently Asked Questions

On 1st February 2023, all EMV chip cards that already been collected will be activated. You will then be able to use your new chip card.

On that same date, your magnetic strip card will be deactivated, and you will no longer have access to the card.

Yes. Chip debit cards distributed or issued after 1st February 2023 will be pinned and activated at the time of delivery. Your magnetic strip card will be retrieved and rendered inactive at the branches. New cards will become active on the next business day.

If you have not picked up your EMV chip card, you will be able to use your magnetic strip card at our POS, ATMs and online until 28th February 2023. All magnetic strip card will be deactivated, and you will no longer have access to your card. Additionally, certain ATM functions including balance enquiry, account transfer and deposits will not be available to you after 1st February.

Yes. You will be able to use your card on POS, ATMs (NBD and other bank ATMs) and online. Deposits can be made as usual at our Hillsborough Street, Bayfront and Portsmouth branches.

We have made a decision to discontinue the statement feature on ATMs. This is in alignment with our “Go Green” initiative. You can use balance enquiry on the ATMs or MoBanking to check interim balances and transactions. The new EMV card has a contactless feature. Contactless transactions can be made on EMV enabled POS terminals that support these transactions. There is an EC$200 per transaction limit to help safeguard you against fraud.

You can change your PIN at any branch. Note that the new PIN will become active on the next business day.

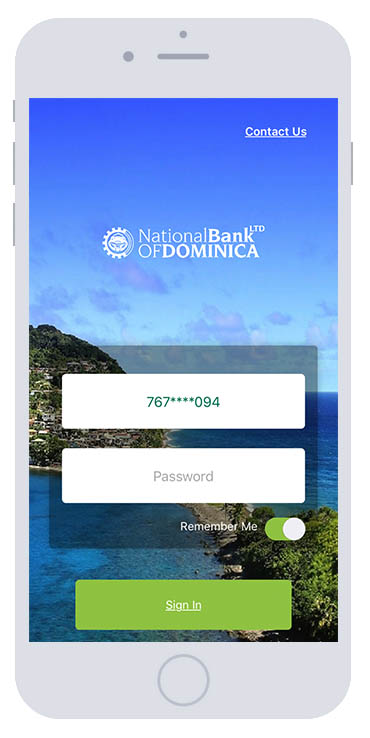

Digital Banking.

Manage your NBD accounts via our Mobile Banking App anytime for full control of your finances. Enjoy these great features at your convenience from anywhere, at anytime.

- Bill Payment

- Pay a Buddy

- Account Alerts

- Check Your Balance

- Plan & Budget

- Transfer Funds

- View Cheque Orders

- ATM/Branch Locator

Download the App

Questions?

Visit us, call 1-767-255-2300, or Ask NBD via the form provided.

Contact us using the information below.