DIGITAL BANKING

Digital Payments & Transfers

Pay Bills. Pay People. Send EFT & Wires

3 Reasons to use Digital Banking

It's Simple

See all your accounts in easy to use interface. It's that easy and that simple.

It's Clear

Get a clear picture of all your transactions and expenses, broken down by category.

It's Secure

Our quick but secure authentication process keeps you safe while banking online.

Bill Payments.

Instead of signing in to multiple sites or standing in line to pay bills, make the process easier with online and mobile bill pay options.

3 easy steps:

- Set up your Payees with your account information

- Select the Payee

- Make your payment by choosing the account you want to pay from and entering the amount you want to pay.

Don't have an account as yet?

People Pay.

Send funds to famliy and friends via MoBanking. You will need your payee’s MoBanking ID and account number to set up as a buddy.

- Pay a Buddy

- Make Payments Using SMS Shortcodes

- Quickly Transfer Funds

- It’s Safe. It’s Secure. It’s Quick.

Direct Deposits and Standing Orders.

It only takes a few minutes to sign up for Direct Deposit and guarantee immediate access to the funds from your payroll or social security benefits. Eliminate the need to visit a branch every payday. Visit an NBD branch to sign up.

Sign up for Standing Orders and automate monthly payments from your account to NBD or accounts at other banks and never forget to make a payment again.

EFT can be used to transfer funds to these participating banks within the Eastern Caribbean Territory. For other currency transfers, a Wire Transfer is required.

- Dominica

- Antigua & Barbuda

- Anguilla

- Grenada

- Montserrat

- St.Kitts & Nevis

- St.Lucia

- St. Vincent & the Grenadine

Electronic Funds Transfer (EFT).

Electronic Funds Transfer Technologically, a faster and cheaper way to send EC funds locally and regionally.

Send funds easily and securely to and from NBD and thirty-six (36) banks within the ECCU countries.

Benefits

- Set up regular deposits

- Improve funds management

- Move funds securely

- Increase efficiency and reduce cost

- One payroll listing for payments to various financial institutions

How to transfer funds via EFT?

You will need the following information to make a transfer:

- The name of the bank receiving funds

- The type of account receiving funds (e.g. checking or savings)

- The bank’s routing number/BIC number/Transit number

- The recipient’s name and account number

Incoming Electronic Funds Transfer

Funds can be sent from your bank via one of the participating banks within the Eastern Caribbean Territory listed to National Bank of Dominica Ltd.,

You will need to provide your bank with the following information:

- Routing number: 500080203

- Your Name and NBD Account Number

- Remittance Information

WIRES.

Use Wires to transfer funds to non-participating regional and international banks.

| COUNTRY | BANK | SWIFT CODE |

| United Kingdom | Bank of America | BOFAGB22 |

| USA | Bank of America | BOFAUS3N |

| Canada | Bank of America NA | BOFACATT |

| Antigua | Antigua Commercial Bank | ANCBAGAG |

| Barbados | Republic Bank Barbados | BNBABBBB |

| Grenada | Republic Bank of Grenada | NCBGGDGD |

| Jamaica | Sagicor Bank Jamaica | RBTTJMKN |

| St.Kitts | St. Kitts-Nevis-Anguilla National Bank | KNANKNSK |

| St.Lucia | Bank of St.Lucia Ltd | BOSLLCLC |

| St.Vincent | Bank of St.Vincent | NCBVVC22 |

| Trinidad and Tobago | Republic Bank of Trinidad and Tobago | RBNKTTPX |

Outgoing Transfers

Transfers from Dominica are routed through one of the corresponding banks listed, to your requested beneficiary bank. You will need the following information to complete your transfer:

- The Routing, ABA, Swift, Sort Code or Transit number of the beneficiary bank.

- The name and address of the beneficiary bank

- The account number, name and address of the person you are transferring the funds to.

- Remittance information (reason for transfer) with supporting documentation where applicable

Incoming Transfers

Funds can be sent from your bank via one of the correspondent banks, listed above, to National Bank of Dominica Ltd.,

You will need to provide your bank with the following information:

- NBD Swift code: NCDMDMDM

- Your Name and NBD Account Number

- Remittance Information

Allow 2 to 3 business days for processing of incoming wires.

Don't have an account as yet?

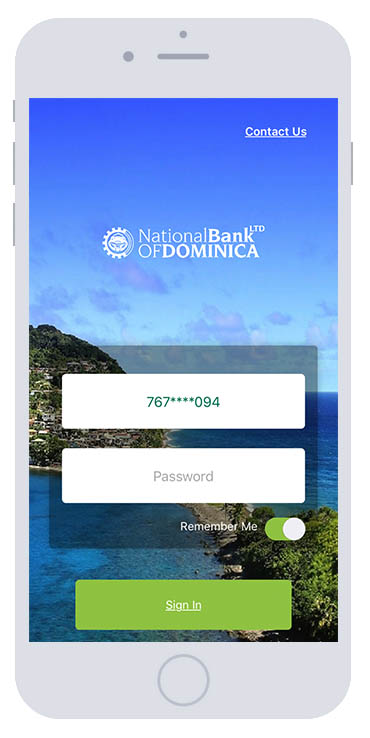

Digital Banking.

Manage your NBD accounts via our Mobile Banking App anytime for full control of your finances. Enjoy these great features at your convenience from anywhere, at anytime.

- Bill Payment

- Pay a Buddy

- Account Alerts

- Check Your Balance

- Plan & Budget

- Transfer Funds

- View Cheque Orders

- ATM/Branch Locator